Life Insurance in and around Mount Juliet

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Mount Juliet

- Lebanon

- Gladeville

- Hermitage

- Old Hickory

- Nashville

- Hartsville

- Gallatin

- Hendersonville

- Murfreesboro

- Wilson County

- Smith County

- Davidson County

- Rutherford County

- Carthage

- Gordonsville

- Watertown

State Farm Offers Life Insurance Options, Too

The average cost of funerals in America is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your loved ones to meet that need as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help your family afford funeral arrangements and not experience financial hardship.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Why Mount Juliet Chooses State Farm

You’ll get that and more with State Farm life insurance. State Farm has terrific policy choices to keep your family members safe with a policy that’s personalized to match your specific needs. Thank goodness that you won’t have to figure that out on your own. With strong values and excellent customer service, State Farm Agent Jeff Gannon walks you through every step to provide you with coverage that covers your loved ones and everything you’ve planned for them.

Interested in finding out what State Farm can do for you? Visit agent Jeff Gannon today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Jeff at (615) 773-9000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

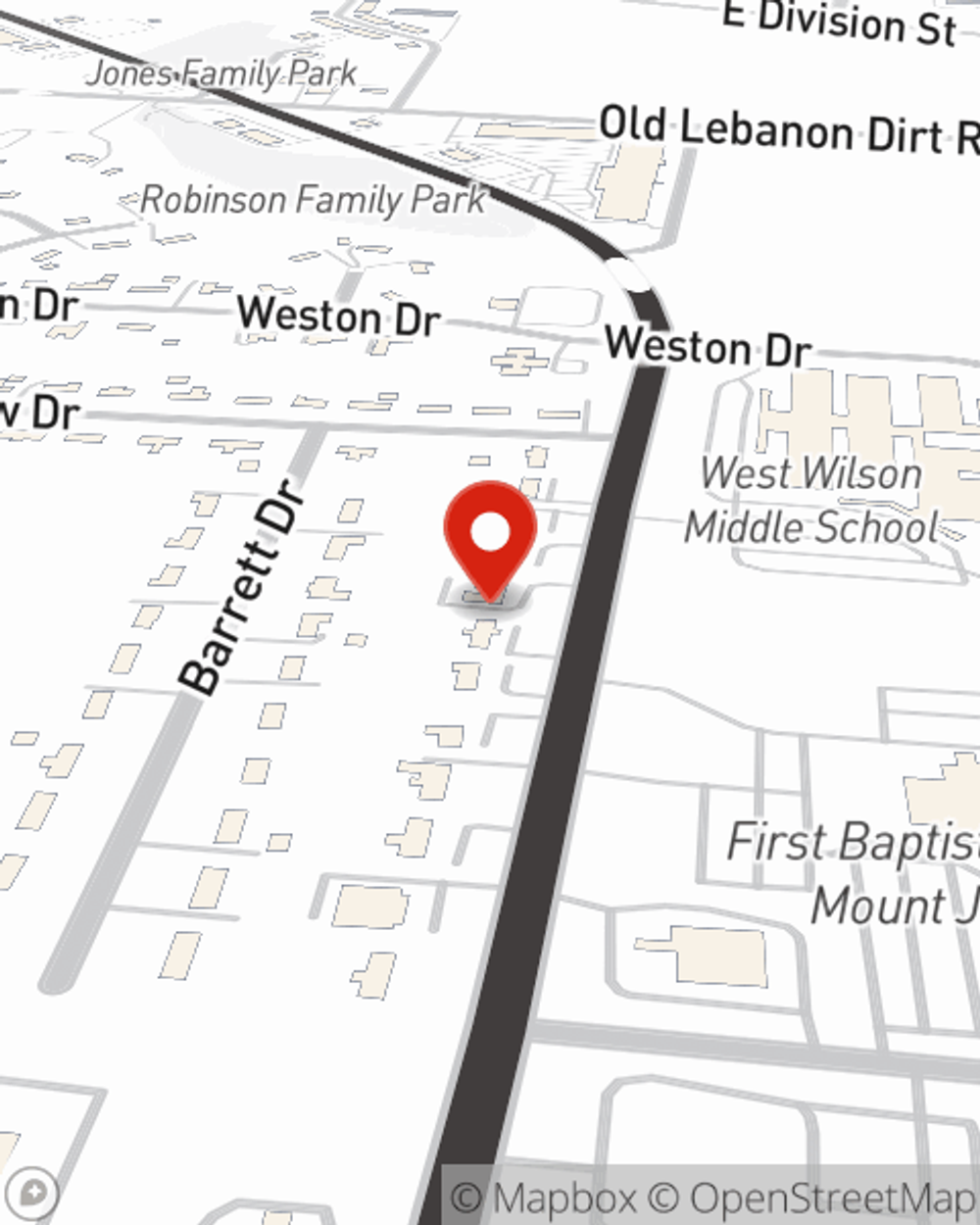

Jeff Gannon

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.